La economía no es una ciencia exacta… Hay muchos matices… Lo que está claro es que lo que vivimos es una crisis de deuda en toda regla, con una implicación que es chutar a la economía con más deudas para que no haya recesión… ¿Hasta cuándo estará los bancos centrales hinchando a la bestia?

In Part I of this series I discussed central banks and their policy actions in context of macro trends including secular growth stagnation, demographics, and technology and highlighted why the math doesn’t work. In this Part II I’m aiming to analyze the underlying fundamentals to discern the substance of our economic reality currently and going forward.

And frankly this is a complex and tricky exercise as a large part of the current economy is completely debt financed and not driven by organic growth. In fact, all efforts by governments and central banks since the financial crisis in 2008 have centered around artificial stimulus to bring the patient back to life. As I alluded to in Part I this has been the standard modus operandi for decades, but in an environment of secular declining growth it takes ever more stimulus and effort to generate growth. The end result: Much of the growth and the data we are seeing is overstated.

My premise: Without constant debt spending and stimulus the economy would be in a recession already. I realize that’s quite the statement to make, but let me walk you through the data and trends and you are of course free to make your own judgement.

Consider: Goods & services consumed with credit cards, cars purchased with loans, expenditures & tuitions financed by debt, government expenditures financed by debt, etc. are all counted as part of official GDP.

And, to be fair, it continues to be a hell of a party across every aspect of society. Government, businesses, consumers, you name it:

The US government has added almost $10 trillion in debt in just the past 8 years. Anyone want to net out $10 trillion out of the past GDP results? I didn’t think so:

And, based on the CBO projections I showed in Part I one can expect this to grow to at least to $30 trillion by 2026 no matter who is president. Debt expressed as a percentage of GDP has almost doubled since 2002:

I could write an entire article on the global picture, including Japan and China, but you get the drift anyways. It’s horrid:

None of this is alarmism, it’s just factual.

And the consumer? Loading up:

Household debt has increased to $12.3 trillion with credit card use increasing among people with low credit scores. What is described as good news: Low rates keep delinquency rates low. What happens when rates rise? After all this is what the Fed keeps promising with their dot plot.

Corporate debt? Same picture:

And expect this trend to continue in 2016 in a big way. In Part I I raised the pension issue and I can’t overstate its importance and relevance.

Consider this: Aside from government pensions S&P companies themselves are dreadfully underfunded in their pension obligations:

“The combined pension deficit for S&P 1500 companies ballooned to $568 billion at the end of June, a $164 billion increase from the end of 2015.”

That’s a 40%! increase in just 6 months for those that are counting. The kicker:

“Falling interest rates have caused pension obligations to rise this year. Under accounting rules, declining rates trigger an increase in pension liabilities.”

And so what do they do? Companies have to take on more debt to meet the pension obligations. Example:

“International Paper Co., a paper and packaging company, tapped the bond markets on Tuesday to help pay down its pension obligation. The company joins General Motors Co., which took similar steps in February, in taking advantage of low borrowing rates to cope with a surge in corporate pension liabilities.

Memphis, Tenn.-based International Paper borrowed $2.3 billion in bond markets, and will use $500 million of that to fund contributions to its pension plan, according to a company press release. International Paper had a pension benefit obligation of $4.2 billion at the end of June, and has taken several steps this year to reduce the burden. It contributed $250 million to the plan in the first half of the year, and paid $1.2 billion to employees as part of a voluntary buyout plan during the second quarter.”

So you see central bank policies are not only putting pension funds under severe pressure but corporate America as well as they all have to take on more risks to generate growth and companies have to increase their debt levels to cover the funding gaps.

Is this a positive?

But the growth game in taking on more risk is not working. Only 15% of large-cap active managers have beaten their performance benchmark this year, the WORST performance on record.

So the temptation is to just say: Screw it, I HAVE to buy stuff that goes up and hence global capital gets increasingly concentrated in a few stocks while ever more debt is issued to keep it all running. This year alone $1.21 trillion in investment grade debt has been issued so far and that’s up 10% year over year.

That’s investment grade debt. What about the shaky stuff, i.e. non investment grade?

“In August, the number of “weakest link” companies rose to 251, the highest since October 2009, up from 140 two years ago, and heading toward the record of 300 in April 2009 when the financial world was coming unglued.

These weakest links have $359 billion in debt outstanding.

The S&P US default rate rose to 4.8% as of July. S&P expects it to rise to 5.6% in June 2017. That may be optimistic. The default rate was 1.4% in July 2014. As it began rising over the past two years, S&P consistently underestimated how far it would go. Last November it was 2.8%. In nine months, it has jumped 2 full percentage points.

The default rate for energy companies is 21.7%.

And yet, liquidity is once again sloshing knee-deep through the system, trying to find a place to go. This includes refugees from negative interest rates in Europe and Japan. In this environment, even teetering Chesapeake was able to swap debt for equity and raise new money to be burned in the near future.”

“North American life insurers have accidentally doubled their distressed-debt holdings in just six months. In the future, they are poised to build on that mound by design.

Companies including Prudential Financial Inc. and MetLife Inc. held $1.32 billion of bonds that were in default, or close to it, at the end of the second quarter, their highest level since the middle of 2011, according to Bloomberg Intelligence data.”

Is this a positive?

So let me see if I have the components of this spiral correct: Central banks are killing yields with low rates, funds are chasing yield in stocks but are underperforming, pension funds can’t keep up with growth targets, hence corporations are forced to raise debt to meet obligations and use part of the debt to buy back their own shares, all of which is causing pure multiple expansion as no organic growth is to be found anywhere and default risks are rising steeply.

“Back on December 31, the trailing 12-month P/E ratio was 17.9. Since this date, the price of the S&P 500 has increased by 6.9% (to 2185.79 from 2043.94), while the trailing 12-month EPS has decreased by 1.9% (to $111.89 from $114.19). Thus, both the increase in the “P” and the decrease in the “E” have driven the increase in the trailing 12-month P/E ratio to 19.5 today from 17.9 at the start of the year”.

And this multiple expansion has continued despite Q3 earnings estimates continuing lower as well. In fact, the EPS estimate for Q3 is down 5.4% over past 26 weeks and down 2.5% since June 30 according to FactSet:

Is this a positive?

“Inevitably, non-GAAP figures are diverging ever further from accounting reality. In a study of 380 S&P 500 companies, the Analyst’s Accounting Observer calculated that their “adjusted” net income rose 6.6 per cent to $804bn last year. It sounds great until you discover that under GAAP precisely the opposite was happening. Net income at those same companies actually declined almost 11 per cent to $562bn — a full 30 per cent less.”

So what’s real? What’s not? Your neighbor may look super successful with a big house and shiny new cars until you realize he’s loaded to the hilt with financial obligations. Low rates may make it all possible, data sets may look promising, but the facade can be deceiving.

Indeed assessing the health and growth prospects of any economy is notoriously fraught with uncertainty and forecasting is very much subject to misjudgment. Just ask all the economists that keep getting surprised by the data.

And nobody is really worse at this then the Fed itself as it has been over-promising and underdelivering for years.

One may rightfully ask: Why trust the judgment of an institution that constantly gets it wrong? I think it’s a fair question:

Since 2004 the Fed has always overestimated growth except once. Is it then a wonder that the Fed’s credibility is shrinking?

Confidence is a very big issue, in fact, it may be one of the biggest drivers of what could produce the next recession, hence nobody likes to talk about a coming recession or tends to ignore data and risk factors that point to one. Did the 2007 market that made new all time highs with regular frequency price in a coming recession that would drive the $SPX to 666 by spring 2009? The answer is of course not, it ignored the underlying risks and data sets.

And today we find ourselves in a similar situation as the public narrative by the majority, including the Fed, is that there are no signs or little risk of a coming recession. On that point: The Fed has never forecasted a recession. They are in the business of trying to project confidence. They react to recessions, they don’t predict them.

So what is the recession risk?

First off, let me be perfectly clear: Nobody can predict a recession with certitude of any sort, but they are part of the normal business cycle and central banks have not eliminated recessions. They may try to delay the inevitable, but they can’t prevent them.

I maintain that given unprecedented low rates and extremely high debt levels the world is completely unprepared for one and my take is that the next one could be a very harsh one if the debt/credit bubble falls on its own weight and if companies are making use of the new technological developments in the works (see also Part I).

Are markets missing the boat on recession risk? Let’s looks at some data points.

Firstly let’s recognize that most recessions occur at or near the beginning of a new presidency. It’s actually quite an uncanny relationship. While not every new president gets a recession at the beginning of their first term, clearly most of them have had to deal with one as only a couple of presidents in the last 55 years did not have to deal with a recession in their first term:

And generally speaking, stock markets get hammered during recessions:

I’ve found 4 recurring, common elements preceding recessions (there are other factors of course as well). But I found these of particular interest:

Corporate profit growth is slowing and/or turning negative ahead of a recession:

Household net worth growth appears to be slowing ahead of a recession:

Along with it we can note that consumer confidence growth is also slowing and near the zero line:

And, lo and behold, (and unfortunately FRED only gives data to 1995), but U6 unemployment growth slows and then turns back up toward the zero line before the recession hits:

I submit that all these factors are either present now or in process. Which is ironic because most everyone is looking at absolute levels not growth levels. And those data sets say consumer confidence is high and unemployment is low. All true, but we need to look for the changes in growth and those strongly suggest that a recession may be possible in 2017 or 2018. And if that’s the case get ready for a major stock drubbing once markets price one in.

Personally I don’t think it’s an accident that the Fed discussed how to handle the next recession at Jackson Hole this summer. They have access to the same data.

What sparks a recession? Many factors play a role and I won’t go through them here in detail, but one of the factors is confidence. Confidence in job prospects, in markets, in the political system, etc. Once that confidence is shaken spending and investment gets tightened.

So in this context it’s ironic that markets are near all time highs yet consumer confidence growth is slowing and earlier we saw that confidence in the Fed itself is shrinking.

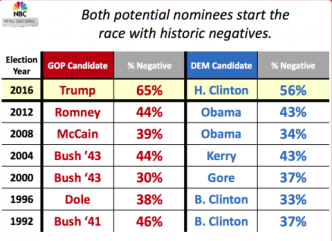

Here’s another reality: In January America will have a new president. As we have seen in the earlier data most new presidents get a recession to deal with. But this is the first time in history that both candidates are disliked by a majority of the American public before either is even elected into office.

How is this confidence inspiring for Americans to wake up in January to a president the majority of them don’t like?

Let this sink in: Neither Donald Trump or Hillary Clinton will have a broad majority support by American voters when either gets sworn in in January.

Is this a positive?

Let me so bold and state that, based on the data, neither of these two candidates will produce a swell of excitement and optimism in the near future. I wonder if the presidential debates will crystallize this problem in the days ahead.

None of this is priced in by markets yet. However, as we saw in 2007, markets can be a bit slow to clue in.

Let’s dig deeper still and look at trends and factors that raise concern.

Let’s start with the consumer:

“Lower gas prices dragged down gasoline-station sales by 2.7% in July. Sporting-goods sales fell 2.2% in the month, the biggest drop since January 2015.

Food and beverage sales declined 0.6%, the biggest drop since May 2011.

Building-material and garden-equipment sales slumped 0.5% and clothing sales also slipped 0.5%.”

Is this a one 0ff? Not really. Retail sales growth has been meager for a while:

And it is really a surprise considering the underlying data?

While there has been talk of increases in wages, growth in real compensation per hour has actually been dropping:

And that’s a problem considering that disposable income growth has also been on the decline:

And, as mentioned earlier, household net worth growth has been shrinking quite dramatically:

How’s this all even possible with stock markets at all time highs? Well, most people are not exactly owning a lot as we have seen:

And considering how much stimulus, debt and central bank balance sheet expansion has been thrown at society this chart above is really an abomination and embarrassment because the bottom 90% carry the debt burden of it all, but did not partake in its benefits.

Worse, it is precisely the bottom 90% that will bear the brunt of the next recession. Again.

Is this a positive?

What the Fed has accomplished is inflate housing prices again which was a specific intent to repair the ruined balance sheets of the banks. Remember mark to market?

Yet consumers are becoming casualties of this effort (with net worth growth dropping and wage growth questionable) as key monthly expenses are increasing significantly, the largest line item being rent:

In context of dropping homeownership this implies more people being affected by higher rent prices:

In fact wage growth has not kept up with the cost of housing and it’s causing real pain and problems across the globe especially in key urban areas:

Note the gap there? What does a chart like this look in real human terms? Consider the Bay Area:

“Things have gotten so pricey that this week alone two high-profile people have been driven out of the Bay Area. San Francisco Federal Credit Union CEO Steven Stapp said he’s taken another job in Portland, in large part because his rent in San Francisco is too high.

And a member of Palo Alto’s planning commission, Kate Vershov Downing, posted a public letter of resignation on Medium, saying she and her family can’t afford the $6,200 rent of a house they share with another family.”

For reference: The median home price is $1.1 million in San Francisco and $2.5 million in Palo Alto. Just load up with debt.

Lest not forget ever increasing medical costs:

To summarize: Net worth growth, real compensation growth and net disposable income growth are declining while rents and medical care keep rising.

Is this a positive?

So is it any surprise that the growth in consumer confidence is dropping?

Bulls will tell you: Don’t worry, consumer credit is at all time highs, let them load up on more debt:

But again, look at the underlying growth rate, here we see a very different picture. Consumer credit growth has actually been slowing dramatically:

Perhaps this partially explains the slowdown in vehicle sales:

Not exactly exciting is it? And if an economy completely dependent on debt expansion can’t even see growth in that area is it any wonder that things are slowing down everywhere?

And don’t tax receipts signal that something is amiss?

Retail sales and GDP growth has been disappointing in all of 2016. Yet the Fed keeps insisting on 3.5% GDP growth for Q3. Is this optimism justified?

The data trends warrant caution as exemplified by the recent ISM data sets:

No way, now how, do you get 3.5% GDP growth with data like this. 1% perhaps, 2%? I don’t know, all I know is that leading indicators keep dropping:

Industrial production has been dropping:

Gross private investment growth has turned negative:

Now put all these data trends in context of population and productivity growth:

While the world continues to add a billion people at a clip of every 13-15 years ( just staggering numbers) the actual growth rates have been slowing , which is probably a good thing on an ever overpopulated planet, but it puts a cramp on global GDP growth as fewer people enter the work force to replace the masses that eventually retire. And that’s one of the big structural problems the world is facing that no central bank or government can change.

And look, none of what I’m outlining here should be a surprise. It may not be covered broadly as such, but it is recognized by many.

One of them is James Bullard of the St Louis Fed.

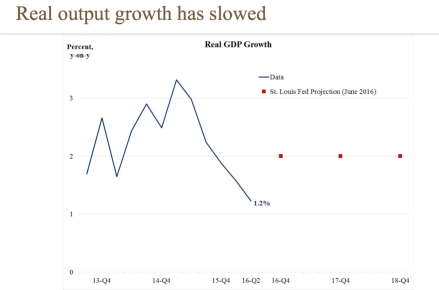

“The old narrative held that, as inflation and unemployment gaps narrowed to zero, the policy rate would have to rise. Today, inflation and unemployment gaps are indeed near zero—business cycle dynamics have completely played out seven years after the end of the recession. This suggests that—since inflation and unemployment are at normal levels—the policy rate should also be near its normal level.”

That’s right. The Fed should have normalized rates a long time ago. But they can’t:

“In the new narrative, the concept of a single, long-run steady state is abandoned. Instead, there is a set of possible “regimes” that the economy may visit. Regimes are viewed as persistent, and switches between regimes are viewed as not forecastable. The current regime appears to be characterized by slow growth and low real rates of return on safe assets. Implication: The policy rate will likely remain essentially flat over the forecast horizon to remain consistent with the current regime.? This implication is very different from the previous narrative….If there are no major shocks to the economy, this situation could be sustained over a forecasting horizon of two and a half years.”

In other words: There’s no growth so we should not raise rates. For years to come.

And he is reflective of reality:

And it’s a global, ongoing, issue:

And so it’s no wonder that EPS growth can’t catch a break:

Let me highlight this: Compounded annual EPS growth is sinking, debt loads are increasing, pension obligations are rising, growth is slowing and investors feel compelled to buy markets with net debt over EBITDA at all time highs:

But stock markets are dancing at the all time highs party. Maybe the corporate sector is doing so much better than the consumer. Let’s see:

Corporate profit growth has been negative:

So has corporate net cash slow:

And sales growth has been trending negative as well:

But, hey, there’s a seeming improvement to observe. Perhaps the earnings recession is over and happy days are coming and that’s why stocks are flying higher.

Well good, in that case businesses must be busy investing for all that growth to come?

But no, business investment growth has been trending negative too:

And why would they invest? After all new orders growth is sucking wind:

Hey at least we are super productive to keep margins expanding? Nope, productivity growth is just awful:

Real output growth is what it is: Nada

Import growth? Shrinking:

Export growth? Sinking:

Construction spending growth? Sinking:

Commercial real estate prices? Slower growth:

So where’s the growth? Are you ready?

Delinquencies on commercial loans? Ripping higher:

And let’s put the last chart into historical context:

Delinquencies on credit card loans remain low due to low rates, however even here we are seeing a shift in the growth rate:

The bottom line: Growth rates have been slowing all across the board and in many cases are negative.

So given all this data I just presented here’s Janet Yellen at Jackson Hole in August stating the following:

“I believe the case for an increase in the federal funds rate has strengthened in recent months”

Get real.

Would Janet Yellen risk a broad market sell-off with these data trends right in front of the US election in November? We shall find out soon, but I’m not holding my breath.

Like probably many of you I am wondering what the end game is here and how it will all play out and there are no easy answers.

Central banks made a big bet ever since 2008/09, but didn’t get the results they wanted so they keep desperately doubling down to avoid the next recession. All their efforts should have produced growth but they haven’t, and they don’t know why or refuse to acknowledge as to the why and so they don’t know what to do, but keep throwing more money at the problem.

And as Part I and hopefully the data here shows: They have no choice. The entire system depends on it.

And let me be clear: They are not at fault for the secular trends that are all around them. However they are not offering solutions, they are in the business of masking the symptoms and in the process they are producing side effects that may prove just as lethal as the root cause.

To summarize key realities: Earnings have been declining and productivity is decreasing. Pension funding gaps are widening forcing companies to raise debt, and funds to increase risk asset allocations. Low yields are causing artificial capital flows into risk assets resulting in a crowding into a shrinking selection of asset classes elevating valuations via 100% multiple expansion. Recession risk in historical terms is rising and supported by data while consumers are increasing debt loads via credit cards and auto loans while libor rates are rising. Real wage growth remains absent as consumers are struggling with rising rents and medical costs. Manufacturing, industrial production and private investments are on the downturn.

If this all sounds structurally bearish it is, because none of these facts will magically change overnight. Yes, growth may bounce here and there for this reason or another, but the structural reality is do deeply ingrained that it presents a circular mathematical problem that cannot be solved on the current path.

Rather, on the current path, the world is experiencing the largest artificial asset allocation in modern history, one that is driven by a misguided interest rate regime that has lost its efficacy and is producing more harm than good. Yet the fear of withdrawal pain is keeping central bankers from doing the inevitable: Quit. The response is predictable:

What are the implications for markets? The data shows that current GAAP earning levels are commensurate with a price equilibrium much lower than current prices. Yet in 2016 the combined action of global central bankers has proven yet again that they can still cause price squeezes higher independent of earnings, growth or the economy at large.

But investors may want to pay attention to one additional reality: Increasingly they are partaking in a marketplace where many participants are purchasing equities either because they literally have to, or are part of an illustrious group of players that face absolutely no personal consequences for overpaying. Think central bankers, buybacks, index funds, pension funds. Many are just chasing yield. And as we saw again on September 9, 2016, the bid can disappear in an instant, yet people were happy to bid up stocks for weeks on end only to see 8 weeks of price range being taken out in 2 days.

Consider: 50% of the market cap of the entire S&P is concentrated in just 50 stocks. $2.3 trillion in market cap is now held by 5 companies alone:

$AAPL $583B, $GOOGL $545B, $MSFT $449B, $FB $376B, $AMZN $371B. Too big to fail? Thin leadership with everyone owning all the same stocks?

What really is the depth of this market were it ever to get really tested?

Abrazos,

PD1: No te olvides de ponerte hoy tu mejor sonrisa. Recuerda: Tú puedes cambiar este mundo!