Interesantes comentarios que se han publicado en el FT. Ayer volvió a caer con fuerza la banca, cuyos accionistas castigan ante las dudas del sector:

Lex in-depth: Universal Banks

One-stop banks always have an excuse for lacklustre performance, but it is time for them to make bold changes

It was a cruel moment. A barb from a direct competitor at a sensitive time. As JPMorgan Chase was preparing its fourth quarter numbers in January, Goldman Sachs took aim. "Debate about a break-up growing louder," its analysts wrote, they then proceeded to lay out the case for splitting JPMorgan in to two (or even four).

The Goldman analysts were right to raise the question. Although it dislikes the term, JPMorgan is a prime example of a universal bank. Others — Citigroup, Bank of America Merrill Lynch, Barclays, Deutsche Bank — also combine retail and investment banking but JPMorgan is the most prominent.

And universal banks have been, to put it politely, a disappointment. JPMorgan produced a return on equity of 9.4 per cent last year. That is barely adequate but it is the best of a bad bunch. None of the others made it past 5 per cent. And last year was not out of the ordinary. Those five universal banks together have managed an average return on equity of 5 per cent over the past five years. There is always an excuse — fines, new rules, restructuring charges, tough conditions in one market or another — but these are all part and parcel of universal banking.

Compare that with the specialists. Look at Wells Fargo, which is predominantly in the retail sector, with a 12 per cent five-year average ROE. Or even Goldman, a pure investment bank, with 11 per cent.

The universal banking model is broken, a fact some banks have realised. UBS and RBS have moved. Others — Deutsche and Barclays, for example — have been less radical so far and need to go further. The US universal banks are the most wedded to the model, promising better returns in the future. But shares in almost all of them trade at a discount to specialists. The message from investors is clear.

Not what we signed up for

There ought to be benefits to scale, especially when it comes to funding and to covering the growing costs of compliance and IT.

Marianne Lake, JPMorgan's chief financial officer, was in fine form at the bank's investor day in February as she laid out the case for its structure — $15bn in cross-selling benefits and $3bn in cost synergies adds up to $6bn-$7bn of net income, or 30 per cent of the group total. That is a big chunk of profit to put at risk in the vague hope that the resulting companies would merit a higher stock price.

Academics are less convinced. Berenberg points out that two years ago the Bank for International Settlements looked at whether size brought benefits in banking. Of 37 academic studies reviewed, only 15 said it did. Hardly a resounding show of support.

Most of the universal banks are failing to prove that economies of scale exist. Cost-to-income ratios — a measure of an institution's efficiency— are high at the universal banks: JPMorgan's is 63 per cent, Citi's 72 per cent and Bank of America's 88 per cent. Again, the specialists tend to do better. Wells Fargo and Santander manage 58 per cent and 47 per cent respectively. Goldman, manages 64 per cent.

Diverse companies ought to be safer. As one side of the business falters, the other thrives and the ship sails on. Some of the biggest failures of the crisis — Lehman Brothers, Bear Stearns, Washington Mutual, HBOS — were specialists, rather than universal banks.

So in theory, diversification should reduce funding costs. And that is before we even get into the debate about whether big banks benefit from an implicit government guarantee or whether cheap retail deposits can be used to finance (supposedly higher returning) investment banking activities — a practice that post-crisis regulators are stamping out.

But these benefits are also absent. Post-crisis rules force the biggest global banks to hold more shareholder capital, a relatively expensive form of funding. JPMorgan will eventually have to have a common equity tier one capital ratio of 11.5 per cent. Citi will probably need about 11 per cent (the rules are still being firmed up). Smaller, less systemic banks can get away with holding less.

On the debt side universal banks, with all their diversity, do not tend to enjoy lower credit ratings. JPMorgan, Deutsche, Citigroup, Goldman and Wells Fargo all have single A ratings from S&P. Prices of the credit default swaps — the cost of insuring against a default — are not much lower either. Insuring against a default from JPMorgan or BofA is cheaper than for the likes of Goldman and Santander, but more expensive than Lloyds and Wells Fargo, according to Markit.

That may be because of the added risks of complexity and opacity. As banks grow, it becomes more difficult for management to have full control. HSBC was taken by surprise by its Swiss private banking operation. The problems are a decade old but Stuart Gulliver, the chief executive, says he cannot know what all 257,000 of the bank's staff are doing. In 2012 JPMorgan lost $6bn in the so-called London whale incident, when it lost control of risk-taking in its chief investment office. Such complexity was a big problem in the crisis, when banks struggled to understand what was on their own balance sheets let alone everybody else's.

The universal banks have to change. They have three options.

The axe

The most obvious is to get out the axe and sever one of the limbs. The Royal Bank of Scotland is attempting something like this, dispensing with most of its investment banking activities. It plans to cut risk-weighted assets in the investment bank from £147bn in 2013 to as little as £35bn by 2019.

Investment banking is a popular target for cuts. Revenues in the industry have been falling 6 per cent a year since 2009, according to data from Morgan Stanley and Oliver Wyman. The fixed income, currencies and commodities sectors — the most capital intensive part of the business — have been falling 9 per cent a year.

But the axe does not have to fall on the investment bank. For Deutsche, its retail arm appears to be the bigger obstacle to profitability, employing €14.4bn of equity for a 6 per cent return in 2014. Germans tend to borrow little and there is a lot of competition for those who do. Deutsche should spin off its retail business and become a specialist investment bank, pushing companies to borrow in the capital markets rather than via bank balance sheets.

This would not be an easy process. In particular, the departure of the bank's €210bn of retail deposits would pose a challenge for the liquidity coverage ratio (a new rule stipulating that all long-term assets have to be matched by long-term liabilities). So in response it would have to cut assets in the investment bank to balance things out — Jefferies thinks a cut of €100bn is necessary. But that would not be a disaster.

The scissors

For those who lack the stomach for such radical solutions, there are the scissors. Here the example is UBS, which in 2012 decided to scale back its investment bank to focus on wealth management. Equity employed in the investment bank has shrunk from SFr10.9bn in 2012 to SFr7.6bn at the end of last year. Its share price has felt the benefit. Before the 2012 changes, the shares traded at 0.8 times book value. They now trade at 1.4 times.

Two banks would benefit from this sort of approach. The first is Barclays. It has committed to cutting its investment bank but the unit, which uses £15bn of equity — almost as much as the better performing retail business — produced an ROE of 2.7 per cent last year. The cuts have not gone far enough. Incoming chairman John McFarlane may have an appetite for hefty reforms. An investment bank serving UK-based corporate clients and perhaps also working with Barclays' African interests would make sense. If that means that the 2008 acquisition of Lehman's US operations looks like a mistake in hindsight, then so be it.

The other is UBS's local rival Credit Suisse. Incoming chief executive Tidjane Thiam is unlikely to have been brought in with a mandate to expand the investment bank. Like UBS, it should shape its investment operation to serve the wealth management business. Analysts at Deutsche estimate that an exit from most of the FICC businesses, for example, would release SFr10bn of capital and that the drop in earnings could be offset by the higher share price. (Credit Suisse trades at a 30 per cent discount to UBS.)

The nail file

This is the easiest approach. Tweak some parts of the business as rules and market conditions evolve, but stick with the idea that universal banking will eventually pay off. JPMorgan, with its insistence on the cross-selling benefits and cost synergies, fits into this category. It is making some changes — cutting costs in the investment bank by $2.8bn (or 13 per cent) by 2017, for example. But the shape of the bank is not changing.

In JPMorgan's defence, it is making universal banking work much better than its peers, and performs better than many specialists. It promises to deliver a return on tangible equity (which tends to produce higher numbers than straight ROE) of 15 per cent over the next three years, against last year's 13 per cent. Higher interest rates, plus the possibility that the biggest fines have been paid, should help all of the universal banks.

But JPMorgan's share price, at one times book value, suggests a degree of scepticism about the model — Wells Fargo and Goldman both attract higher ratings. The scepticism is not limited to JPMorgan. A small shareholder has forced a break-up proposal on to the agenda for the Bank of America annual meeting, and plans to push similar proposals at Citigroup and JPMorgan.

The banks are not unfamiliar with break-ups. In recent years JPMorgan has advised Liberty Media, CBS, Time Warner and News Corp on their demergers or spin-offs, according to Dealogic. The objection is that the costs of a split would be huge. And so they would. But that is no reason to stick with a failing business model which, over the long term, will destroy more value than the one-off shock of a break-up.

And this is just the moment when the model should not be failing. The US economy grew 2.2 per cent last year and is forecast to grow 3 per cent this year. Such conditions ought to be good for US banks, despite the drag from low interest rates. The sun is shining; the universal banks ought to be making hay. But they are not. Even the best of them only just covers its cost of capital.

For the universal banks, then, 2015 is a critical year. If they cannot make the model work, they should admit that the nail file has failed — and get out the axe.

Abrazos,

PD1: Los bancos españoles salieron a competir por ahí fuera…, para evitar tener todos los huevos en España:

En más de una ocasión hemos señalado en este mismo blog la relevancia y singularidad del negocio internacional de la banca española. Relevancia por cuanto midamos como lo midamos, sea como peso en sus balances consolidados de la exposición internacional o alternativamente como la contribución al beneficio de los negocios no domésticos, dicho negocio tiene una importancia capital para el sector. Singularidad porque esta circunstancia no se da en la misma magnitud en ninguno de los otros grandes países de la eurozona. El recientemente publicado Informe de Estabilidad Financiera del Banco de España proporciona una visión actualizada a cierre de 2015 de esta realidad.

El gráfico de más abajo es bien ilustrativo. Nunca antes en la historia, el negocio en el extranjero de la banca española había alcanzado un peso tan sustancial: prácticamente la mitad de sus algo más de tres billones de euros de activos totales (el 45% siendo precisos), en tanto que dicho negocio en el exterior "sólo" representaba el 25% al inicio de la crisis. Por supuesto, ello es consecuencia de la reducción de los abultados balances domésticos previos a la crisis derivada del proceso de desapalancamiento de la economía española. Ahora bien, no lo es menos del apetito que la banca española ha seguido teniendo por la expansión internacional. La adquisición del británico TSB por Banco Sabadell el pasado año o la reciente OPA de Caixabank por el luso BPI, donde ya ostenta una mayoría significativa, son exponentes de que incluso ese apetito va más allá del que históricamente han desplegado los dos grandes bancos españoles: Santander y BBVA.

El continuo crecimiento del peso relativo de los activos extranjeros respecto a los de España se está produciendo además en el ámbito que es más natural: con un modelo de negocio minorista. En efecto, como puede observarse en los gráficos posteriores, las tres cuartas partes de esos activos en el extranjero de la banca española son préstamos, de los que la mitad se concentra en hogares y un 30% en empresas no financieras.

Un aspecto no menos destacable es su localización geográfica. Si hace años la expansión y el mayor peso relativo de los mismos se concentraba en Latinoamérica, la dinámica de los años más reciente ha sesgado el posicionamiento hacia Europa y Estados Unidos, algo que quizás se ha interiorizado menos en los análisis del sector al uso. De hecho, a cierre de 2015 la mayor parte de los préstamos en el extranjero (casi dos terceras partes) se localizan en estas dos áreas geográficas, siendo muy inferior (en torno al 25%) el porcentaje de préstamos localizados en carteras de los países latinoamericanos. Más aún, considerados de forma agregada estos últimos, y a pesar de la enorme presencia en grandes países como Brasil y México, suponen un volumen inferior que la cartera de préstamos de las entidades españolas en el Reino Unido, que por sí sola alcanza algo más de un 30% del total. Tampoco es despreciable la presencia en Estados Unidos, que concentra el 15% de la cartera de préstamos de la banca española en el extranjero, siendo el segundo país después del Reino Unido, y muy por encima de los mencionados Brasil (9%) y México (8%).

Como última reflexión, es obvio reconocer que la radiografía descrita es básicamente el resultado de la estrategia de internacionalización desarrollada por las dos principales entidades españolas. La aportación a dicha radiografía del resto de la banca española es meramente testimonial. Tal estrategia, que ha propiciado que en ambos casos casi dos tercios de su actividad se desarrolle fuera de nuestras fronteras, les ha permitido surfear los duros años de la crisis en mejores condiciones que la mayoría de sus homólogos europeos. Por supuesto, mejor también que el resto de la banca española sometida casi en su totalidad a los designios del crecimiento doméstico. Aún hoy, en el que una parte significativa del negocio en el exterior está dando muestra de debilidad, su contribución permite que la rentabilidad del negocio global de ambos bancos se mantenga algo por encima del promedio de bancos españoles con orientación puramente doméstica. También por encima de la media de sus principales referencias europeas.

PD2: ¿Solo sirve para esto?

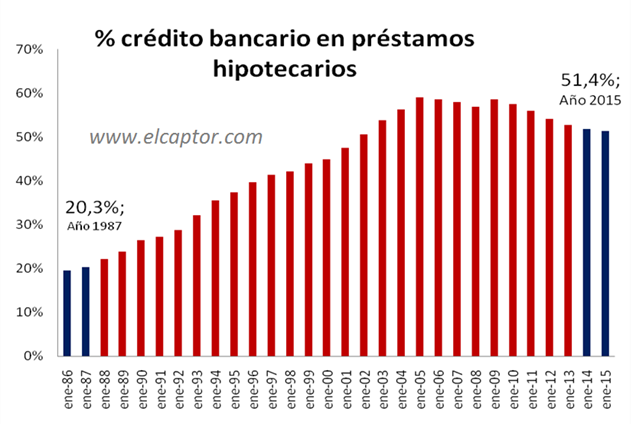

El último artículo de nuestra sección "conceptos de economía" se ilustra con un gráfico sobre el porcentaje del crédito bancario formalizado en España mediante préstamos hipotecarios. Pretendemos responder a la pregunta: ¿Para qué sirve la banca? a través del análisis de una serie de datos y ejemplos.

Imaginaos la siguiente respuesta: "Sirve para garantizar el correcto desenvolvimiento del conjunto de interrelaciones económicas."

Definición breve, directa y contundente. Sin embargo, ¿no deberíamos resolver con antelación qué quiere decir exactamente "correcto desenvolvimiento"?

Pensad por un momento si la adquisición de vivienda habitual mediante un préstamo hipotecario formalizado en un plazo de 30 años debería "entrar" o tipificar dentro de lo que consideramos "correcto desenvolvimiento".

Es decir, pensad si puede ser o no razonable que cualquier joven trabajador de 25 años de edad que quiera independizarse para vivir por su cuenta deba endeudarse hasta los 55 años de edad con una entidad bancaria mediante un préstamo que supuestamente promueve "el correcto desenvolvimiento del conjunto de interrelaciones económicas".

Añadamos un ejemplo más para profundizar en esta cuestión.

Una empresa del sector inmobiliario construye un bloque de 50 viviendas, por cuyo motivo solicita -y obtiene-financiación bancaria al objeto de poder llevar a cabo la realización del proyecto. La obra dura dos años y la totalidad de los pisos son vendidos antes de la finalización de la construcción de la promoción.

Bajo este supuesto la constructora se habría liberado de la totalidad del crédito bancario en un plazo de 2 años, mientras que cada uno de los compradores finales de las viviendas habría formalizado posteriormente su correspondiente préstamo hipotecario por un plazo medio de 30 años. ¿"Correcto desenvolvimiento"?

Volvamos al gráfico inicial para terminar. Actualmente en España más del 50% del crédito bancario concedido al sector privado -empresas y familias- se encuentra formalizado en préstamos hipotecarios, lo cual quiere decir que la mayor parte de la financiación otorgada por los bancos no está dirigida a actividades productivas (tal y como por contraposición puede observarse que en la década de los 80 sí sucedía).

Y eso es exactamente para lo que debería servir la banca; para promover en el corto plazo la actividad económica pero no la perpetuidad de ninguna deuda de carácter personal o familiar ligada a la adquisición de vivienda habitual.

PD3: ¿Recibimos algo a cambio de rezar? Lo que recibimos de Dios es gracia sobre gracia. Por tanto, ¿es necesario rezar? Sabemos que lo que recibimos es gracia, es entonces cuando la oración tiene más valor: porque es "inútil" y es "gratuita". Aun así, hay tres beneficios que nos da la oración de petición: paz interior (encontrar al amigo Jesús y confiar en Dios relaja); reflexionar sobre un problema, racionalizarlo, y saberlo plantear es ya tenerlo medio solucionado; y, en tercer lugar, nos ayuda a discernir entre aquello que es bueno y aquello que quizá por capricho queremos en nuestras intenciones de la oración.