Aquí lo cuentan con detalle y muy clarito:

The Emerging Markets Rout Continues

In my last piece I said that you’re not really diversified if you don’t hate something in your portfolio at the moment. Stocks are the obvious candidate right now, as they were down anywhere from 6-10% in August depending on which market you’re looking at.

But bad months are nothing. The true test of a long-term investor comes when there are bad multi-year periods. Emerging market stocks fit the bill on this one. EM stocks are down 21% as a group since May 1 of this year. Since they peaked in late November of 2007, emerging markets have a total return of -24.3% through the end of August. That’s nearly 8 years with a return of -3.5% per year. In the same period, the S&P 500 is up 52.3% or around 5.5% per year since the last cycle peaked.

Two obvious questions come to mind when looking at this data:

+ Why would an investor allocate money to emerging markets when they have these types of dry spells?

+ Why would a diversified investor continue to hold emerging markets during this type of environment?

Both are valid questions and the answer depends, as always, on the individual investor’s own risk profile and time horizon. The volatile nature of the emerging markets probably aren’t suitable for everyone. But let’s take a look at the historical data to get an idea about why anyone in their right mind would hold these developing countries that are prone to the boom/bust cycle.

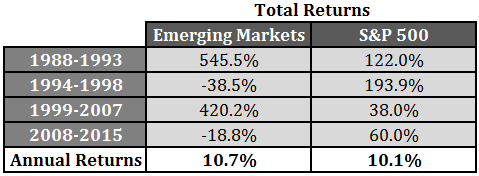

Here’s the long-term picture of the cyclical nature of the over and underperformance in the MSCI Emerging Markets Index set against the S&P 500 going back to the EM’s inception in 1988:

The annual returns for the two market segments are fairly similar but the path to get there was not. Both have taken turns leading and lagging. The differences have been quite large at times. So if both have had similar long-term performance, what’s the point of holding each in a portfolio?

Now let’s see what would have happened if you would have utilized a simple 50/50 split between U.S. stocks and emerging market stocks with an annual rebalance back to those weights:*

This is where the real benefits of diversification really show up. The fact that the return streams for these two markets were so different and volatile actually makes the combined returns much better than the individual parts. A rebalancing bonus to the tune of one to one-and-a-half percent per year is pretty remarkable over close to a thirty year period.

There are certainly many good reasons to avoid emerging markets at the moment. China is slowing. Inflation is out of control in certain countries. Commodities are down big. The dollar is rising. Interest rates may follow at some point. The thing is that there are always going to be short-term issues and not just in developing countries but everywhere.

The biggest problem most investors have with a diversified portfolio is that it rarely “works” over the short-term. Asset allocation is a long game. There could be cycles that last a number of years before you’re able to see the benefits of holding assets that have different risk and return characteristics.

Diversification sounds simple. It is in theory, but simple isn’t the same thing as easy. Simple can be extremely hard to implement.

Abrazos,

PD1: Se ha revisado unas décimas el crecimiento de Asia emergente:

Y la OCDE también ha bajado un par de décimas el crecimiento global:

PD2: Sí, ya sé que China son 1300 millones de personas frente a los 330 millones de EEUU, pero se comen cerdos a cholón…

Y no solo cerdos, importan mucha materia prima:

Es inmensa:

PD3: Los millonarios, personas que tienen más de un millón de dólares al margen de su vivienda habitual, son más ya en Asia Pacífico que en EEUU:

PD4: El turismo está decadente. ¿Qué le interesa ahora a la gente? Los museos, de lejos; las iglesias, desde fuera; y las cervecerías, por dentro... No interesa el arte, sólo piensan en cómo llenarse la barriga de lo que sea…