Bloomberg lo comenta en un amplio estudio, algo técnico:

GROWTH TARGET

6.5 Percent Target Tests Market's Faith in China Growth Story

China appears set on a testing target for growth in the years ahead. Recent remarks from President Xi Jinping and other leaders suggest 6.5 percent will be the lower threshold for GDP growth in the 13th Five-Year Plan, the blueprint for the economy from 2016 to 2020. That reflects the long-standing objective of doubling the size of 2010 GDP by 2020, seen as critical to achieving a "moderately prosperous society" in time for the 100th anniversary of the founding of the Chinese Communist Party.

Bloomberg Intelligence Economics' analysis of China's potential growth rate suggests 6.5 percent growth in 2020 is attainable, just. That would reflect a slowing contribution from capital accumulation and productivity gains, and a slight drag from labor supply as the workforce shrinks. Projections from the International Monetary Fund put growth in 2020 at 6.3 percent, after a dip to 6 percent in the interim as the economy works through challenges from the rapid buildup of leverage and industrial overcapacity.

If the target is achievable, it is also testing. China faces numerous challenges in the years ahead. Economy-wide debt of more than 230 percent of GDP, real estate construction that is running 2 million units a year ahead of fundamental demand, and a working age population that will shrink more than 10 million in the next five years are all obstacles to sustaining growth around the current level. Some analysts are forecasting a significantly sharper slowdown, expecting growth in the low single digits by the end of the decade.

China's growth target has implications for the policy mix going forward. It's certainly true, as Premier Li Keqiang has said, that strong growth provides a supportive atmosphere for reform. It's much easier to close down loss-making state-owned enterprises, for example, if the private sector is growing fast enough to generate job opportunities for redundant workers. At the same time, pressure to hit stretching growth targets could also encourage officials to go back to their old play book of credit-fueled investment spending. That's an unsustainable solution.

Potential Growth Forecast

GDP Growth Proxies

A second potential pitfall is commitment to a 6.5 percent target could open a widening gap between what the official data say about the growth rate and where cynical market participants perceive it to be. Already in 2015, National Bureau of Statistics data reporting growth close to the 7 percent target has been met with skepticism from some analysts. BI Economics' monthly GDP tracker puts growth at 6.6 percent in the third quarter. Other analysts are more skeptical, with some proxy indexes putting the current

growth rate as low as 3 percent.

The risk, then, is that as the government goes all out to double the size of the economy, China's GDP data are increasingly regarded as a political number rather than an unbiased economic measure. That reduces the value of the data as a guide to policy makers, businesses and investors. A step change in transparency by the National Bureau of Statistics — so GDP calculations are replicable from published source data — isn't part of the 13th Five-Year Plan. Perhaps it should be.

REFORMS

Getting to 6.5% — How China's 13th Five-Year Plan Addresses Challenges to Growth

Sustaining growth at 6.5 percent requires China's government to rebalance the economy across multiple axes:

+ Investment to consumption as driver of demand

+ Manufacturing to services as source of output

+ Low-cost assembly to high-value innovation as the basis of competitiveness

+ State to private ownership

+ Credit-intensive growth to deleveraging

Here's how the 13th Five-Year Plan proposes to do it, and some of the obstacles that stand in the way.

Raising the share of household consumption in GDP has been a long-standing goal of the government. Progress during the 12th Five-Year Plan was slow, with the share of household consumption in GDP at 38 percent in 2014, compared with 36 percent in 2010. The 13th Five-Year plan aims for a "significant" increase in the share of consumption in GDP.

Getting there will require a combination of household income expanding faster than GDP and greater coverage of welfare services to reduce the need for precautionary saving. A generational shift from the frugal elders of the Mao era to the free-spending children of the reform era could give policy makers an assist. Expanded welfare coverage for hundreds of millions of migrant workers requires a reordering of the fiscal system that has so far proved elusive.

The transition from manufacturing to services as the main source of output is already under way. At the start of the 12th Five-Year Plan, services accounted for about 44 percent of output and manufacturing for 46 percent. So far in 2015, the shares have been 50 percent and 41 percent, respectively. Higher household income, which drives greater demand for services, accounts for part of the transition. So, too, does the progressive eradication of subsidies to industry in the form of artificially low government-set prices for utilities, credit and the exchange rate. The 13th Five-Year plan will target a continued increase in the service sector's share of GDP, as well as the liberalization of factor prices. With China's accountants, hair dressers and waitresses providing services for firms and workers in the manufacturing sector, they will not be immune to the slowdown in the rest of the economy.

Consumption and Investment as Share of GDP

Innovation is the new buzz word for China's leaders. That reflects the recognition that higher productivity is necessary to offset the drag from a shrinking working-age population and rapidly rising wages. The 13th Five-Year Plan promises to ratchet up investment in research and development and target financial support at strategic emerging industries. Even with increased spending, easy gains from catching up to global technology leaders will be increasingly hard to find. Developing the culture of innovation necessary to push back the technological frontier is even more

difficult. China ranked 34th in the World Economic Forum's index of innovation and sophistication in 2015, slightly down from 31st in 2010. That's a move in the wrong direction.

difficult. China ranked 34th in the World Economic Forum's index of innovation and sophistication in 2015, slightly down from 31st in 2010. That's a move in the wrong direction.

China's government has no intention of giving up its control of the commanding heights of the economy. Strategic assets in energy, banking and telecommunications will stay under state

control. Even so, the state sectors' share of total assets, which fell to 38 percent in 2014 from 41 percent in 2010, will continue to edge down. The government's plan for reform of the state sector, based on dividing firms into strategic, public interest and commercial will plow ahead. Reform of factor prices, which removes an implicit subsidy to inefficient state

firms, will accelerate the transition. A litmus test of success will be whether private firms can provide telecom and other critical services over networks that remain under state control.

firms, will accelerate the transition. A litmus test of success will be whether private firms can provide telecom and other critical services over networks that remain under state control.

One of the main challenges China's policy makers face in the years ahead is reining in runaway credit expansion. Outstanding credit has risen to 232 percent of GDP in 2014 from 203 percent in 2010, according to BI Economics' calculations. Such a rapid expansion in borrowing relative to the ability to repay brings risks of bankruptcy in businesses and instability in banks. The shift toward the service sector and private firms — which are less capital intensive and have higher return on assets — is critical to escaping the debt trap. So, too, is continued reform of the financial sector, with plans for relaxing controls on the capital account, opening banking to private participation and raising the share of direct finance from the bond and equity market.

CAPITAL ACCOUNT

Opening China's Capital Account — No 'Financial Crocodiles' Allowed

China's 13th Five-Year Plan may target 2020 as the date for yuan convertibility on the capital account. That would be a major shift from the current system of quota-controlled cross-border flows, with far-reaching implications for China and the world. The trialing of yuan convertibility in the Shanghai Free Trade Zone signals that policy makers mean business. Memories of the Asian Financial Crisis also linger — during which international investors, referred to in China as "big financial crocodiles," laid neighboring economies low. That means the financial system likely won't open its door to large-scale short-term portfolio flows.

Publicity surrounding the progressive opening of China's capital account has been intense. The Qualified Foreign Institutional Investor, Renminbi Qualified Foreign Institutional Investor, Qualified Domestic Institutional Investor and Hong Kong-Shanghai Connect schemes have all blazed a trail across the headlines. The reality, though, is that, relative to the size of China's capital markets, the total cross-border investment allowed under the schemes remains miniscule. Total allowed investment is 2 trillion yuan, relative to a market size of 69 trillion yuan.

Proponents of accelerated opening argue that cross-border capital flows are necessary to increase the efficiency of investment, prevent the build-up of bubbles in domestic asset markets and accelerate reform of the financial sector. They also argue that a substantial volume of cross-border flows are currently hidden in the trade and foreign direct investment accounts. A more liberal capital account regime would bring those hidden flows into the light, boosting stability by giving policy makers a complete picture.

Against that, the bitter experiences with capital account opening for China's Asian neighbors counsels continued caution. The lesson of the 1997 Asian Financial Crisis — when Korea, Indonesia and Thailand were hit by the sudden exit of foreign funds — has not been lost on China's policy makers. The rapid rise and equally rapid fall of China's equity markets in 2015, triggered in part by the anticipation of inflows from the Hong Kong-Shanghai Connect, does not inspire confidence that the domestic markets are mature enough to deal with major cross-border flows.

Cross-Border Investments a Small Part of Total Market Cap

Cross-Border Portfolio and Other Investment Flows

The fragility of the domestic financial system adds to the case for caution. Bank assets have doubled in the last five years, even as slowing growth and weaker corporate profits add to fears about borrowers' repayment ability. One of the main reasons that situation appears manageable, is because almost all borrowing comes from domestic banks and almost all of banks' funds come from a stable domestic deposit base. Capital account opening would change that picture.

That suggests progress on capital account opening will be accelerated, but controls on large-scale short-term portfolio flows will remain. In the immediate future, higher quotas under the existing QFII, RQFII and QDII schemes, as well as opening of the Shenzhen- Hong Kong Connect would be easy wins. QDII may be expanded to allow individuals to invest overseas. Long-term investors, like pension funds, may get easier access to the China market. Looking further forward, restrictions on domestic firms borrowing from offshore will also be lifted. Financial crocodiles, though, will have to wait at the border.

DEMOGRAPHIC SHIFT

Why China Scrapped Its One-Child Policy

China is finally facing up to its demographic time-bomb, announcing that it will scrap the one-child policy first instituted in the late 1970s and allow all couples to have two kids. Originally envisioned as a way to prevent the nation's population from outstripping resources, the policy instead became something that threatened the nation's growth in the coming decades, and leaders partially loosened the rule in 2013. Here are charts showing statistics and projections that may have pushed Communist Party leaders toward the change as they met in Beijing to hash out an economic framework for the next five years.

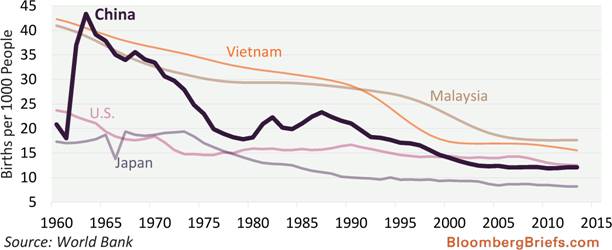

Declining Birth Rate

The number of babies has plummeted as a result of the policy and other changes in China, to 12.1 per 1,000 people in 2013, from a post-reform peak of 23.3 in 1987. That's below the U.S. rate of about 13, Malaysia's 18 and Vietnam's 16, according to the World Bank. The birth rate in Japan, whose demographic problems are well known, is eight per 1,000 people.

Birth Rates Plummet

Shrinking Pool of Workers

The declining birth rate means that the nation will have a smaller and smaller population from which to draw workers. That can hold back economic growth and drive up wages too quickly, leading companies to move factories to lower-cost nations in Asia and elsewhere. The number of people ages 15 to 64 declined in 2014 for the first time in at least two decades, a drop of about 1.6 million, or 0.2 percent, to 1.004 billion.

Labor Force Declines First Time in at Least Two Decades

Aging Population

The demographic shift means an ever-growing proportion of the population will be older, limiting the size of the workforce, boosting health-care costs and putting bigger burdens on younger people to support them. The United Nations projects that the number of Chinese age 60 and older will more than double in the next 25 years to 431 million. In 2050, that group's share of the population will be 36.5 percent, up from 15.2 percent in 2015, the UN estimates.

Graying China

HISTORY

REPORT CARD

Looking Back at the 12th Five-Year Plan

As details of the 13th Five-Year plan are analyzed, it's important to assess the progress of its predecessor. A review of the 12th Five- Year Plan's 17 high-level objectives shows 14 hits and three still incomplete with a few months to go.

CONSUMER STAPLES

Two-Child Policy Baby-Food Boom Clouded By High Costs, Breastfeeding Push

China's policy change to allow for two children per couple is unlikely to cause an immediate baby boom as the large financial commitment deters families. Fifty-six percent of families impacted by the easing of China's one-child policy in 2013 cited high cost as a reason for not having a second child, according to a People's Daily poll.

Families that decide to take advantage of the policy change may switch to cheaper baby formula to save money. That would probably boost demand for value and mid-tier priced products from local companies such as China Mengniu, Biostime, Inner Mongolia Yili and Beingmate Baby & Child Food. Parents will also probably seek out bargains online, particularly popular overseas brands with strong food safety credentials. Nestle, Mead Johnson, Danone and other large multinational companies based outside of Asia are among the top 10 largest baby-food makers in China.

Breastfeeding in China Trails Global Rate

A potential demand boom for baby formula from China's new two-child policy may face constraints from a push to get more Chinese mothers to breastfeed. Only 28 percent of Chinese moms breastfeed exclusively during the first six months, trailing the global rate of 37

percent, according to Unicef China. The government is expanding education programs and adding lactation rooms in workplaces to promote natural feedings. If these initiatives gain traction, they could offset higher formula demand from two-children families.

CONSUMER DISCRETIONARY

Sportswear Brands to Expand Kids Product Lines Even if Child Policy Falls Short

Sportswear brands may expand their children's products in China even if the new two-child policy fails to spur a baby boom. Current demographic trends will increase the number of Chinese children aged 0-to-9 — part of the category's target customers — by 2019, according to the U.S. Census Bureau. This is expected to drive Nike, Adidas and home-grown sportswear brands such as Anta to develop new kids-only products, which command higher margins than adult lines.

Department store and mall operators such as Intime and Golden Eagle, whose stores recorded a 16 percent rise in sales of childrens- and athletic-brands in the 18 months to June, should allocate more space to these products. This should help sportswear brands as they expand kids-only offerings. Nike and Adidas were among the five best-selling childrens' wear brands at Intime and Golden Eagle department stores this year.

Anta and Li Ning, which sell lower-priced athletic gear in China, are rolling out more kids-only products into dedicated shops, according to Bloomberg Intelligence analysis. Anta's value-for-money kids sales grew faster than a 24 percent rise in its first half total revenue. It aims to open as many as 166 new kids shops (from 1,334 at end June) as it closes 140 non-kids stores. This may prompt rival Li Ning to open more such outlets and launch more products dedicated to this segment.

Sportswear Targeted Population in China Is Growing

AUTOS

Electric Vehicles Stand to Benefit From Infrastructure Investments

Chinese consumers have been deterred from buying electric vehicles by a shortage of charging facilities. Under the new economic plan, central and regional authorities will attempt to add enough charging points to accommodate 5 million electric vehicles by 2020.

The market for electric cars, which has been dominated by local brands like BYD, BAIC and Zotye, represents less than 0.5 percent of the country's annual auto sales. There's ample room for foreign automakers like Tesla, Toyota and GM to gain market share.

The government may not be able to rely on traditional short-term incentives like October's tax cut and cash subsidies to boost car purchases. It should expand the asset-backed securities market or other financing tools to help lenders — the auto-leasing market remains almost non-existent. Major automakers like SAIC, Dongfeng, GAC and Brilliance have established financing arms with foreign partners. These will make big-ticket car purchases more affordable in the long term.

Aiming for 31 Percent Jump in Fuel Economy

The market for passenger vehicles, which already account for about a quarter of Chinese retail sales, should increase

as car buyers become wealthier and upgrade to more expensive models. Luxury auto sales account for just 9 percent of China's total, compared with 12 percent in the U.S. and 30 percent in Germany.

REAL ESTATE

Don't Expect a Cure For Real Estate Woes

The push for urbanization and reform of the Hukou system reiterated in the five-year plan aims to support rural residents migrating to urban areas. Demand for housing in tier-two and -three cities may rise as China aims to increase the proportion of registered urbanites to 45 percent of the population by 2020, compared with 35 percent in 2012.

The plan also seeks to double household income from 2010, which would increase the number of potential homebuyers and improve affordability. Home prices were 16 times annual household income in tier-one cities and 8.8 times for tier-two cities last year, significantly higher than in the U.S. (3.6 times) and Japan (4.4 times).

Further opening of the Chinese economy would boost property demand from foreign investment. In August, the Ministry of Commerce loosened restrictions to allow Chinese units of overseas companies and foreign nationals working in China to buy properties for their own use.

Housing Inventories at Levels Unseen in Years

These measures are unlikely to resolve the pain of oversupply in the Chinese property market. Inventories, at a 10-year high in 2014 for key developers from China Vanke to Country Garden and Agile, must first be absorbed before the pace of new housing construction can recover. Real estate fixed assets investments grew just 3.8 percent year-on-year in the third quarter, the lowest since 2004. Prolonged weakness would in turn cause downstream impacts on demand for cement, steel and construction equipment.

LODGING/GAMING

Getting on the Road With the 13th Five-Year Plan

China's urbanization and expansion of clean air initiatives outlined in the 13th Five Year Plan will support long-term trends in domestic and outbound travel.

Increased urbanization will continue to provide support for hotel demand. The number of urban residents have risen 2.5 percent to 4 percent each year for more than 10 years, and now make up 55 percent of the total population. The 13th Five-Year Plan focuses on expanding this base and will extend household registration benefits to newer urban dwellers. In the long-term, this is likely to support increased time and resources for travel.

Millennials and young retirees make up about 60 percent of China's population. The urban segment of this demographic is prime for seeking adventures abroad. Outbound travel jumped 15 percent in the first half, and Thailand, South Korea, Japan, Taiwan and the U.S. are all seeing an increase in Chinese visitors.

Tourism to China has stagnated since 2006. Corporate demand has been stable, but demand from inbound, leisure visitors had been negligible. This may be partly due to severe pollution. With the expansion of current clean air initiatives, easier breathing, clearer views and transportation improvements should enhance China's tourist draw.

Outbound Travel, Urban Adventure-Seekers Set to Increase

The five-year plan also reinforces Macau's development as a world tourism center for Chinese and global travelers. Integrated resorts are the area's biggest attractions and generate critical cash flow. Connections to the Hong Kong airport during this period will also promote Macau as a convention hub. Macau's six casino operators continue to rely on tourism from Mainland China, which generated 67 percent of the city's visitors in 2014.

Global hotel operators are developing more hotels throughout Asia-Pacific that are targeted at middle-class Chinese travelers. Domestic hotel brands may have an advantage with more exposure to consumers in China.

TELECOMS

Expect More Competition for China Telecom, Unicom

China Telecom and Unicom face greater broadband competition after the government opened the sector to private competitors late last year, a strategy reemphasized in the new five-year plan. New entrants, such as Dr Peng, offer 100 MB connections in some areas, which is at least five times faster than the major telcos. Prices are also just 100 yuan ($16) a month versus 120 yuan. There is still potential for overall growth as only about half of people in China use broadband.

Alibaba, Tencent, and Baidu, which are seeking to expand to banking, insurance, entertainment and travel, among others, stand to benefit from a larger user base.

Wireline Data Growth Remains Strong

METALS

Consolidation Push May Benefit Large Producers

China's largest metal makers may see their market share increase as the government pushes for industry consolidation in a bid to alleviate overcapacity.

Metal producers may need to increase investments in production lines to meet stricter environmental protection requirements in the plan, as the country aims to go green. Small-scale mills could be driven out of the market due to expensive equipment upgrades that figure into new requirements already met by most large mills.

Producers could be encouraged to upgrade production lines, extend value chains to highly processed products, and innovate. These steps would help them weather price declines and become more competitive. Metal players may also seek wider applications for their products, such as using aluminum alloy as a substitute for steel.

Five-Year Plan Scorecard for Metals

KEY TARGETS IN THE 12TH FIVE-YEAR PLAN

|

STATUS AS OF 2014

|

ACHIEVED OR NOT?

|

1. To control output of 10 nonferrous metals ≤ 46 Mln tons

| ||

Aluminum output ≤ 24 Mln tons

|

24.4 Mln tons

|

No

|

Refined copper output ≤ 6.5 Mln tons

|

8 Mln tons

|

No

|

Lead output ≤ 5.5 Mln tons

|

4.2 Mln tons

|

Yes

|

Zinc output ≤ 7.2 Mln tons

|

5.8 Mln tons

|

Yes

|

2. Market share of China's 10 largest producers of

| ||

Aluminum = 90%

|

69%

|

No

|

Lead = 60%

|

56%

|

No

|

Zinc = 60%

|

51%

|

No

|

3. General energy consumption per ton of metal produced

| ||

Copper ≤ 300kg/standard coal

|

252kg/standard coal

|

Yes

|

Lead ≤ 320kg/standard coal

|

430kg/standard coal

|

No

|

Zinc ≤ 900kg/standard coal

|

897kg/standard coal

|

Yes

|

SECTOR IMPACT: CEMENT/COAL

Green Initiatives Mean More Pain for Coal, Cement Industries

Polluting sectors like coal and cement are likely to suffer under tighter pollution controls under the new five- year plan, leading to increased operating costs, capex for facilities upgrades and more plant closures, especially among smaller producers.

China seeks to reduce coal use to 60 percent of total primary energy consumption by 2020, compared to 66 percent in 2014. This means coal demand growth may decelerate to a 0.5 percent CAGR in the five years starting 2015, versus 4.4 percent during the 12th Five- Year plan. China will reduce the use of bulk coal, which is the low quality and mostly unwashed coal burned by plants with no desulfurization or denitrification equipment, and by households. Washed coal is preferred by the government, as the washing process may remove as much as 80 percent of the ash content and 40 percent of SO2 content. This also means higher costs for miners. China aims to raise the washing rate from 60 percent to 90 percent by 2020, meeting the level of some developed countries.

China Raw Coal and Cement Output Growth

Coal consumption per tonnage clinker production should be reduced from the current average of 120 kilograms, requiring more facilities upgrades. Anhui Conch, which consumed less than 100 kilograms per ton in 2014, is the industry pace-setter. Low-grade cement, which represents about 60 percent of China's output, is likely to be replaced with high grade product. With higher grade cement, about 20 percent less output is required to achieve the same building strength.

INDUSTRIALS

Global Competitiveness Reliant on Shift in High-Tech Manufacturing

The global economic slowdown has led to declining Chinese exports in seven of the first nine months of this year. Industrial production growth has moderated, and capacity utilization dropped to the lowest levels since the financial crisis of 2008. Industrial enterprises face lower profits since the third quarter of last year. China may be losing its manufacturing competitiveness, particularly for low-value products, to countries with lower-cost labor like India and Southeast Asian countries. In response, China will probably transition to cutting-edge industries to maintain its manufacturing prowess. This will create opportunities for local machine tool builders as well as those in Germany, Japan and the U.S.

Innovations in manufacturing will probably accelerate as Chinese companies build equipment like robots, computer-controlled metal-cutting machines, and measuring and inspection equipment. Whereas the focus has been on quantity in the past, China will reposition itself to accuracy- and precision production to raise the value added component of goods.

Industrial Enterprises Face Lower Profits Since 3Q14

Production upgrades may be necessary to manufacture more of the higher-value goods that consumers will demand as incomes rise. The push for innovation may raise the cost for machine tool makers and manufacturers as they spend more on research and development.

TECH

Green Transformation of Manufacturing

China's 13th Five Year Plan aims to shift its manufacturing base toward a greener and cleaner energy source. That may encourage electronics manufacturing companies such as Hon Hai, Pegatron and Quanta along with their customers including Apple, HP and Lenovo to build their own renewable power generating facilities to supply their energy needs.

Apple has announced the completion of a 40 megawatt solar project in Sichuan province to offset the carbon footprint of its operation and retail stores in China. The company also announced plans to build more than 200 MW of solar power projects while partnering with its suppliers to install more than 2 gigawatts of clean energy capacity by 2020. Hon Hai,

Apple's Renewable Initiatives in China

Projects

|

Capacity

|

Sichuan investment (completed)

|

40 Megawatts

|

Solar projects in northern, southern, eastern China grid regions (by 2020)

|

200 Megawatts

|

Partnership with suppliers (by 2020)

|

2 Gigawatts

|

Hon Hai (Foxconn) - Solar power for iPhone production in Zhengzhou

|

400 Megawatts

|

Source: Apple

Apple's biggest supplier, will install 400 MW of solar capacity for its iPhone production line in Zhengzhou by 2018.

SHIPPING

New Trade Patterns Mean Boost for Maritime Transport

Dry bulk demand has grown at an annual rate of 5.4 percent since China's entry into the World Trade Organization in the end of 2001. Further liberation of the economy under the 13th Five-Year Plan could sustain that momentum. Iron ore makes up 30 percent of global dry bulk shipping with China being the major customer. About 80 percent of iron-ore for its steel mills already comes from imports. Dry bulk shipping would get a boost if low global iron-ore prices closes down domestic mines and increases share of imported iron ore and steel exports.

Coal forms 12 percent of dry bulk ton-miles. China's shift to a greener economy and greater use of gas will naturally limit its coal imports. Liquefied natural gas imports are likely to triple during the course of the five-year plan, as market liquidity in Asia rises from inexpensive gas out of new liquefaction projects comes on-stream, boosting LNG tanker ton-mile demand.

Plans to reduce emissions will limit the sulfur in fuel used for ships, increasing distillate demand and driving introduction of newer bunker fuels in China. Hong Kong introduced rules for berthed ships to use low-sulfur fuels earlier this year, which may be extended to China's Pearl River Delta, Bohai Sea and the Yangtze River Delta. Stricter emission rules could lead to increased scrapping of older vessels or retrofits and new orders for shipyards in China that have struggled in recent years due to excess capacity.

The shift to a consumer-led economy should support containerized cargo imports. China is already the largest container exporter. Increasing container imports into China would correct the imbalance between dominant and non-dominant legs in the current container trades. Empty container relocation costs money and the reduction in this imbalance would have a positive impact on margins of container shipping companies.

Chinese Iron Ore Seaborne Imports

World Trade Volume, Container Ships in Service

Refrigerated cargo demand could double as cold chain logistics proliferate given the increase in food and perishable demand. Improvements in utilization rates of reefer cargoes will aid margins for shipping companies as these generate between two to six times the revenue compared to box cargoes depending on the distance moved.

OIL

Five-Year Plan Promises Oil Reform Upstream, Downstream

China's 13th Five-Year Plan may shift dynamics for the oil sector in both downstream distribution and upstream exploration.

The government continues to regulate retail prices, but over time the price mechanism has become more market oriented. From 2009 to 2012, China reviewed retail prices every 22 working days. In March 2013, that interval shrunk to every 10 working days under certain circumstances. The 13th Five-Year Plan is likely to extend pricing reforms and eventually let the market decide. That will have major implications for downstream distribution of refined gasoline, diesel and kerosene. In particular, it will help Chinese oil majors PetroChina and Sinopec avoid big fluctuations in margins.

The plan may also drive progress on opening up the sector upstream, with greater freedom for the private sector to participate in exploration. China's

Price Mechanism Has Become More Market-Oriented

petroleum industry is dominated by three state-owned enterprises, PetroChina, Sinopec and Cnooc. Low oil prices haveeroded upstream companies' cash flow, making them more prudent spenders. The opening-up of exploration rights may help China boost capital spending and drive diversification of upstream entities.

GAS

More Pipelines by 2020 Could Raise Operating Margins for Distributors

The government plans to accelerate the construction of gas infrastructure over the next five years. Additional pipelines are likely to reduce transmission costs and boost operating margins for distributors such as China Gas, CR Gas and ENN Energy, as some of the gas they supply is delivered at a significantly higher cost by LNG trucks.

The construction of new networks would boost consumption growth as it should hasten the transfer of natural gas from resource-rich western regions such as Xinjiang to high-demand coastal provinces such as Guangdong and Zhejiang.

The national pipeline delivered over two-thirds of gas consumption, according to energy giant CNPC. The expansion of delivery channels has been a major driver of the rapid consumption growth in the past. The length of the network doubled from 2009 to 2014, the same pace as demand growth.

The government may allow third-party access to pipelines controlled by PetroChina, Sinopec and CNOOC, the three largest state-owned operators, to enhance delivery mechanisms and assist the planned opening up of the energy transmission sector.

Gas Infrastructure to Expand in Five Years

POWER

Market-Driven Pricing, Not Greater Capacity, Is Key Target

Plans for the power sector are less about additional capacity and more about sector reform. The authorities will still set higher power-generation targets for 2020, though the key aim is to introduce long-awaited market-driven prices. This means that generators should operate in highly competitive markets.

Utilities already face slow-growing demand and excess capacity, which limit revenue growth, and tighter environmental standards, which raise costs. The reforms will expand direct sales from power plants to users to increase competition among thermal generators.

China has discussed introducing market-driven power prices for years. In March 2015, the State Council stressed a need to "deepen power-sector reforms." It has yet to finalize a blueprint or timeline for power trading, but China is already on the way to taking the steps needed to create an effective, nationwide market.

Eliminating vested interests and creating checks and balances are two of the challenges. A fully functional and effective electricity trading exchange poses price risks for generators as the prices can be volatile.

Electricity Prices in Competitive Markets Can Be Volatile

At the same time, more determined reforms could provide at least two economic stimuli. They could lead to the

merging of the listed subsidiaries of large power groups, raising their profitability by reducing overlap and inefficiencies. A more efficient power sector could bring down prices, providing stimulus to industrial users and the economy.

Clean Energy Remains at Top of Agenda for Next Five Years

The latest Five-Year Plan confirms that shifting China's energy production mix toward cleaner energies is still at the top of the leadership's agenda. The country still aims to raise the power capacity of gas, nuclear, solar, wind and other clean generation in an effort to reduce environmental pollution.

Gas capacity is set to rise to at least 100 gigawatts by 2020 from about 55.7 GW in 2014, though the key obstacle is the high price of gas compared with coal, hydro and nuclear power.

Ongoing gas price reform should reduce power production costs and encourage the building of more plants.

One risk for operators of wind farms and solar power plants is the possibility of the lowering of tariff subsidy in the coming years.

Another risk is that the plan aims to introduce electricity trading markets.

In a fully competitive power market, solar and wind may not be the ideal source given the higher cost, as retailers would seek the lowest cost source.

China's Installed Capacity Breakdown as of 2014

This could be prevented if the government mandates that a certain percentage of power used must come from renewable energy sources.

NEW ENERGY

Energy Plans Target Sustainable Production, Efficient Use

Restraining carbon emissions is a fundamental element of China's 13th Five-Year Plan. To achieve that objective, China's government will follow a two-pronged approach: aggressive adoption of sustainable energy and continued pursuit of energy efficiency. Bloomberg New Energy Finance forecasts that China's carbon emissions will peak in 2021 at the earliest.

Energy targets in the 13th Five-Year Plan period were determined in the "National Energy Development Plan (2014-20)" released by the State Council in October 2014. The principal aims are to increase the utilization of non-fossil resources in primary energy consumption from 10 percent in 2013 to 15 percent by 2020. Compared to the first half of 2015, non-fossil fuel power generation capacity (excluding nuclear) will more than double by 2020, with installed capacity of wind, solar, and hydropower expected to reach 250GW, 150GW, and 350GW, respectively. In addition, 30GW of biomass and 38-49GW of new nuclear capacity will come online in the next 5 years.

BNEF forecasts 254GW of new coal-fired capacity will come online by 2020. In part, these additions will replace retiring plants, most of which are inefficient. Taking account of retiring plants, the net annual installation of coal-fired capacity will be 31GW over 2014 to 2020. Declining costs in wind and solar, as well as the development of a national carbon market will allow renewable energy technologies to become more competitive than coal, but only after 2020. The continued growth of coal-fired capacity will cause carbon emission to increase until 2021 and then decrease by an average of 2.5 percent per year to 2030.

The 13th Five-Year Plan will have to make a reality of China's commitment to reduce carbon intensity 40 percent to 45 percent below the 2005 level by 2020. One approach to carbon intensity reduction is to eliminate inefficient production from energy intensive industries. China currently accounts for nearly half of the world's output in cement, steel and aluminum. The 13th Five-Year Plan will continue to shift China's growth model from heavy industries to advanced manufacturing and services — which are less energy intensive.

China Gross Annual Capacity Additions, Retirements

China Power Sector CO2 Emissions, 2012-40

Since 2012, there has been a significant drop in carbon emissions from the industrial sector. That reflects a combination of reduced industrial working hours, shutting down factories, and the deployment of energy saving technologies. The view from domestic energy service companies though, is that the low hanging energy efficient lightbulbs of industrial energy saving have already been screwed in.

With existing measures likely

insufficient for the government to meet its commitments on carbon intensity, the 13th Five-Year Plan will have to be more ambitious. Part of the answer will be electricity demand side management. After a policy shift in 2015, the industrial sector are now mandated to deploy efficient equipment, use electricity rationally, institutionalize DSM practices, and substitute the direct consumption of oil and coal with electricity. Done right, the build out of industry and infrastructure in China's less-developed central and western provinces will also be an opportunity to lock in higher levels of efficiency.

BANKS

State Banks May Have to Bite the Bullet in New Plan

China's big banks may find themselves in austerity mode starting in 2016 as the 13th Five-Year Plan calls for them to increase support for small and rural enterprises.

This implies more lending by state banks to these companies, which service the agriculture, manufacturing, wholesale and retail sectors — parts of the economy that saw higher-than-average bad debt ratios in the first half of this year. These loans may aggravate their credit quality woes through 2016.

China also plans further reforms for equity and bond markets, aiming to raise their contributions to financing. A policy favoring direct financing over bank loans may threaten lending growth. In the first nine months of the year, equity and bond financing accounted for 17.5 percent of China's total social financing, compared with 14.1 percent for all of 2011 and 17.2 percent last year.

The plan reinforces the nation's support for innovation, providing a boost to

P2P Lending Jumped 11-Fold

Internet financing and crowdfunding. This may fuel the explosive growth of online lending, also at the expense of traditional lenders. China's peer-to-peer lending jumped almost 11 fold to 352 billion yuan ($55 billion) from January 2014 to October 2015. The number of lending platforms rose from 880 to 2,520 nationwide. Alibaba and Ping An also launched crowdfunding platforms during this period.

INSURANCE

Averting China's Health-Care, Retirement Crisis

China's population is aging rapidly, with only 1.3 workers to support a retiree by 2050, from three today, according to the insurance regulator. Addressing a surge in health-care and retirement needs is a key focus in the 13th Five-Year Plan.

For insurers, some reforms may mean national service while others may boost sales opportunities. Critical-illness insurance programs are set to be implemented nationwide by the end of 2015 to help bring-down medical costs for citizens. Insurers will try to break even by collecting enough premiums from local governments to cover claims and expense for major illnesses. In return, insurers can gain vast amounts of customer data and experience to help achieve optimal pricing. China Life and PICC are some of the major insurers that run these programs.

Retirement is another key theme. China's pay-as-you-go system is plagued with low returns and a shrinking working-age population. The government has lifted the decades-old one-child policy and is gradually increasing the retirement age. A tax-deferred pension scheme should be ready for national rollout after years of preparation. That should mean more premiums for insurers, boosting fee income for companies like China Life, Ping An, and CPIC. Finally, China's drive to modernize cities and to build out the One Belt, One Road trade route mean more investment opportunities to help insurers improve returns and lengthen asset duration.

Health Insurance Premiums Rising

FINANCIAL REGULATION

Internet Regulations May Rein in Disruptive Online Financiers

The Chinese Communist Party's ambitions outlined in their draft 13th Five-Year Plan appear to strongly encourage innovative inclusive financing particularly online services. Internet guidelines however released in July may rein in disruptive financiers.

Non-traditional financial services may be encouraged to play a greater role in China's economy to reduce the reliance on the state-owned mega-banks and their traditional deposit taking and lending function. Bad debts rose 48 percent on average at the state banks in the first half. Newly-packaged financial intermediation services such as peer-to-peer lending, crowd funding, internet-based financing, asset securitization, may be encouraged. Such financing models lessen the reliance on bilateral debts between big banks and customers.

China's P2P lending surged 377 percent to 277 billion yuan ($43.6 billion) in August vs. a year earlier. Alibaba and the insurer Ping An have developed peer-to-peer lending platforms Zhao Cai

The rules reflect a tension between banks shifting online and new disruptive internet financiers.

Bao and lufax.com respectively. Property developer Dalian Wanda raised 5 billion yuan ($787 million) selling asset-backed securities online using crowd funding in June.

But while the draft plan strongly supports digital finance, the internet guidelines released by the regulators in July, may tighten state control over the new disruptive financiers. The rules which will not be fully implemented until end 2015 reflect a tension between banks such as ICBC and Bank of China shifting online and new disruptive internet financiers such as Alipay and Baidu. The rules may ultimately favor those traditional financiers moving online who are easier for the government to control and regulate over unlicensed disruptive players.

Amplio, claro y muy ambicioso. Van a liderar el mundo si siguen así… Abrazos,

PD1: ¿Quién irá al cielo? No pienses que solo iremos los católicos apostólicos y romanos… Ni mucho menos. Se salvarán muchos que no sean cristianos. Imagínate que hubieras nacido en Egipto y fueras musulmán y creyeras al Profeta y cumplieras sus mandatos, siendo bueno y practicando tus creencias con plenitud, Seguro que te salvarás. O que hubieras nacido bajo una familia protestante y actuaras con rectitud y bondad, seguro que te salvarás también. O imagínate que naces en una familia atea, que no practica por costumbre, por desconocer la fe cristiana, que es muy buena gente y se cuida y se quiere, y cumple con la Ley Natural…, pues es muy posible que se salve también. Dios es misericordioso y querrá que estemos muchos con Él en el paraíso.

Pero cuidado si conociendo lo rechazas, si sabiendo lo que nos pide, antepones tu yo, tu soberbia, el mundo material que nos rodea, o tu propio egoísmo y pereza para no cumplir lo que sí conoces. Cuidadito, cuidadito, que la misericordia es muy grande, pero la libertad que nos ha dado también… Nos espera siempre, nos lanza mensajes de amor para que le sigamos. No debemos rechazarlos, ni esperar al último segundo…