No consigue arreglar sus problemas…

How Japan Blew Its Savings Surplus:

Financially speaking, Japan is fast becoming a Keynesian dystopia. Its entire economy is now hostage to a fiscal time bomb. Namely, government debt which already exceeds 240% of GDP and which is growing rapidly because even the recent traumatic increase in the sales tax from 5% to 8% does not come close to filling the fiscal gap. Moreover, even at today’s absurdly low and BOJ rigged bond rate of 0.6% nearly 25% of government revenue is absorbed by interest payments.

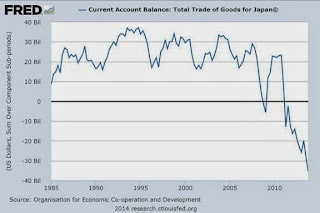

Now comes the coup de grace. Japan’s savings rate has collapsed (see below) and its vaunted current account surplus is about ready to disappear. This means Japan’s accounts with the rest of the world will cross-over into a “financial no man’s land”; it will be forced to steadily liquidate its overseas investments to pay its current bills—an investment surplus built up over the course of 50 years. But this will also reduce foreign earnings and thereby expand Japan’s growing deficit on current account.

Accordingly, to finance its “twin deficits” it will have to attract massive amounts of foreign capital for decades to come—an imperative which will require a devastating rise in interest rates, perhaps as high as 4% according to one expert :

The yield on Japan’s benchmark 10-year government bond, now around 0.6 percent, could rise to 4 percent – a level unseen since March 1995 — should the current-account balance drop into deficit as public debt eclipses the nation’s savings, said Toshihiro Nagahama, chief economist at Dai-ichi Life Research Institute.

Needless to say, were the carry-cost of Japan’s towering fiscal debts to rise by even half that much it would be game over. Interest expense would absorb virtually 100% of current policy revenue, forcing the government to raise taxes over and over. One expert quoted in the Bloomberg article below says that a sales tax of 20%—-nearly tripple the recently enacted level—-would be required to wrestle down the fiscal monster that would result from interest rate normalization.

Unless the government raises the sales tax to 20 percent or makes drastic reform on social welfare spending, this scenario is highly likely,” said Ogawa. “Higherinterest rates will discourage domestic capital investment and spur the shift of production abroad, increasing the number of people unemployed.”

The above quote strongly hints why Keynesian dystopia is an apt description of what is emerging in Japan; and why that descriptor is also reflective of the financial horror show that is coming to our own financial neighborhood a decade or two down the road.

As indicated above, the alternative to an economy killing 20 sales tax is “drastic reform of social welfare spending”. But the latter is not even a remote possibility. Japan’s population is both shrinking and also aging so rapidly that its fast on its way to become an archipelago of old age homes.

Japan savings rate as shown below has dropped from in excess of 20% during its 1970s and 1980s heyday as a mercantilist export power to only 3% today. When Japan’s retired population reaches nearly 40% of the total in the years ahead, this rate will obviously go negative as households liquidate savings in order to survive.

What happened to Japan’s huge savings surplus? The government borrowed it! And wasted it on massive Keynesian stimulus projects that kept the LDP in power for decades but produced bridges and highways to nowhere that will be of no use to Japan’s retirement colony as it ages.

And the adverse demographic tide is indeed powerful as shown by the curve below on Japan’s working age population. In a few short years what was a working age population that peaked at 88 million has dropped to 79 million; and it will plunge to below 50 million persons in the next two decades.

What the Keynesian witch-doctors who advised Japan to bury itself in fiscal stimulation after its financial crisis of 1989-1990 did not explain was how this inexorably shrinking working population could possibly shoulder the tax burden needed to carry Japan’s massive public debt.

Yet there is no other way out of the Keynesian debt trap in which Japan is now impaled. As the current account, also shown below, continues to worsen, the need to import capital to fund the gap will drive interest rates sharply higher. The burden on Japan’s remaining taxpayers will become crushing.

So the graph below should be pasted on every US Congressman’s forehead. When the debt spiral goes too far—it becomes a devastating financial trap. And it cannot ultimately be solved with money printing because if carried to an extreme—even for the so-called reserve currency—it will destroy the monetary system entirely.

It should also never be forgotten that the drastic degeneration of Japan’s public finances happened in real time—–within less than two decades after its leadership was bludgeoned into one fiscal spasm after the next by Keynesian officialdom in the US Treasury, the IMF, the OECD and elsewhere. And this is clearly a case of bad ideas imported from abroad. The generation of officials who lead Japan’s post-war miracle may have been hopelessly addicted to unsustainable models of mercantilist export promotion and currency pegging, but they were not believers in Keynesian borrow and spend.

I know that from personal experience of dealing with Japanese financial officialdom during the early days of the Reagan administration. Quite simply, they were shocked that America was about to take such an immense fiscal gamble by drastically cutting taxes before the inherited domestic spending had been curtailed and the huge defense build-up had been funded.

That was then—at a time when Japan’s debt was under 50% of GDP notwithstanding two decades of government directed internal economic development. Yet just a decade latter— after being bludgeoned to drastically appreciate the yen after the Plaza Accord of 1985—their export mercantilism model broke-down in a vast financial bubble and bust engineered by the BOJ.

Thus, left completely at sea, they were sitting ducks for visiting Keynesian fireman like Professors Bernanke and Summers. Japan then launched upon the greatest experiment in Keynesian fiscal stimulus ever imagined. The catastrophic results speak for themselves and are a potent remainder that bad ideas can wreak immense damage once they are embraced by the machinery of the state.

Mira más datos:

Japón ha pasado de ser un país exportador a tener dificultades e importar demasiadas cosas:

Ha dejado de tener un saldo comercial exterior positivo, a meterse en déficits y más déficits:

Parte de culpa la tiene la evolución del yen:

Ya no es tan productiva:

Y desde el punto de vista de su déficit público, su situación es horrorosa:

Motivada en su abultada deuda pública que se come mucho presupuesto:

Tiene que vender bonos públicos a cholón, siendo su banco central el que empieza a quedárselos todos… ¿Te suena?

Esta es la evolución de sus bonos:

Con implicaciones negativas de aumento masivo de su oferta monetaria, venga a darle vueltas a la maquinita de imprimir…

Le sube la inflación y generar tipos reales muy negativos…

Con una inflación que ha pasado de ser un problema porque era negativa a ser un problema de ser demasiado positiva…, de estar disparada… Esa pérdida de solvencia que produce cuando te pasas de imprimir papelitos…, que tantas veces te he contado

No tiene apenas paro:

Además cuenta con una población envejecida que provoca unos gastos crecientes en pensiones:

Siendo las expectativas de crecimiento de población muy pobres, en un país cerrado a la inmigración…

Ni siquiera destacan por turismo… No se va a Japón, no interesa:

Y como resumen: su gravísimo problema: sus deudas. Se desbocó hace muchos años, y no hay quien la pare…

Todo esto viene a cuento del proceso de japonización que estamos teniendo otras muchas economías… ¿Les copiaremos hasta el final?

Abrazos,

Pero hace un par de días escuché un bonito argumento en favor de atender a los ancianos, incluso aquellos que no nos reconocen, que no pueden reconocernos, que no pueden hacer nada por nosotros. Ha sido en la homilía en el entierro de la madre de un amigo mío. El sacerdote ha dicho que, precisamente porque esas personas no pueden darnos nada, ni siquiera una sonrisa, ni un agradecimiento, nosotros podemos obtener lo más importante: podemos sacar de nosotros mismos lo mejor que tenemos, que es darnos a los demás con absoluto desinterés, sin esperar nada a cambio.

En nuestra sociedad predomina el contrato: doy para que me des y, a ser posible, en un intercambio de iguales: doy 100 porque tu me das 100. En ese entorno, la vida de un anciano demente o con Alzheimer no vale nada, por definición. Pero eso no es verdad, porque yo estoy recibiendo algo de mucho valor: estoy aprendiendo a dar sin esperar recibir; estoy ejercitando el don, la gratuidad, la generosidad. El negocio es muy bueno, porque estoy mejorando como persona. El que no vea esto, no lo entenderá y considerará que atender a un anciano dependiente es una pérdida de tiempo, de dinero y de recursos. Lo siento: se ha olvidado usted de su capital humano, social y moral, y está empobreciendo usted a la sociedad, porque si usted no aprende a dar, está enseñando a los demás a no dar.

Claro que, es verdad, esto sólo lo puede entender el que se atreve a hacer el experimento. Podemos añadir argumentos menos altruistas, como el de que si los demás no aprenden a dar, usted va a experimentar los efectos de la eutanasia. Pero me parece que este argumento no moverá a muchos. La propuesta es mucho más audaz: atrévete a dar sin esperar nada a cambio, y tu vida cambiará a mejor.